Accounting Assumptions, ASC 842 Test, Outputting Reports

Make sense of your data. See how to explore assumptions in FASB lease accounting, understand finance and operating lease requirements, and generate ...

Solutions

Workplace Management Solutions

Real Estate Management Solutions

Maintenance Management Solutions

Energy Management Solutions

Engineering Document Management Solutions

Asset Management Solutions

Automate campus scheduling for classes, meetings, and exams with our EMS software.

Plan and manage conferences effortlessly with EMS software to impress guests and streamline operations.

Boost workplace flexibility and maximize space use with seamless desk and room booking.

Organize workplace or campus events smoothly, creating memorable experiences.

Optimize workspace, manage allocations efficiently, and reduce costs with our space management solutions.

Deliver projects on time and within budget by improving communication, collaboration, and efficiency with our software.

Streamline lease accounting for ASC 842, IFRS, and GASB compliance.

Manage leases efficiently by tracking key dates, analyzing costs, and ensuring compliance.

Centralize data and analytics for better insights, faster negotiations, and revenue growth.

Centralize facility and asset maintenance, automate work orders, and ensure compliance with our CMMS software.

Extend asset life, reduce downtime, and prevent costly repairs with data-driven monitoring.

Prevent equipment failures and extend asset life by detecting and addressing issues early.

Make sustainable, cost-efficient energy decisions by monitoring and optimizing power consumption.

Remotely monitor and control equipment with real-time data to predict issues, boost efficiency, and reduce downtime.

Easily share and collaborate on documents, creating a single source of truth for engineers and contractors.

Manage and analyze assets across their lifecycle to schedule maintenance, reduce downtime, and extend lifespan.

Improve visibility, automate work orders, and ensure compliance for efficient facility and asset management.

Resources

Browse our full library of resources all in one place, including webinars, whitepapers, podcast episodes, and more.

Self-Service & Support

Looking for self‑service training, best practices, helpful videos, product resources, or support? You’re in the right place.

About Accruent

Get the latest information on Accruent, our solutions, events, and the company at large.

ASC 842 lease accounting requires the disclosure of a company's leased assets, classification of lease as finance or operating, and reporting monetary values.

Table of contents

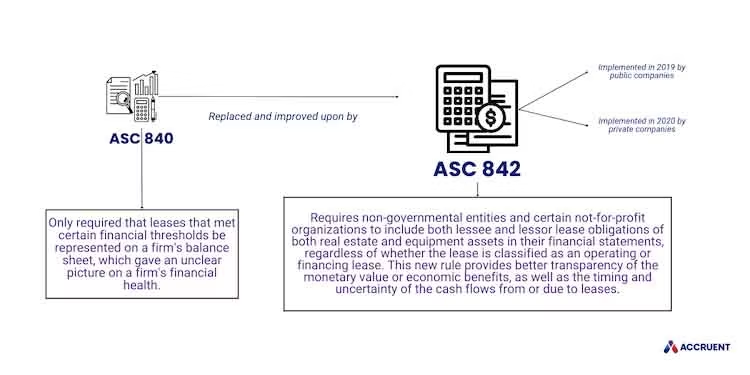

ASC stands for Accounting Standards Codification. ASC 842 is the new lease accounting standard published by the Financial Accounting Standards Board (FASB), which public companies were required to adopt in 2019 and private companies were required to adopt in 2020. ASC 842 requires the tracking and disclosure of all a company's leased assets and replaces the previous US GAAP lease standard, ASC 840.

Lease accounting -- guided initially by Financial Accounting Standard or FAS 13 and subsequently by ASC 840 -- required leases that met certain financial thresholds to be represented on the balance sheet. It was those latest ASC 840 regulations, in the early 2000s, that were identified as needing to change.

The FASB took up the challenge of creating a follow-up to ASC 840. However, it took the better part of a decade, two Exposure Drafts and several disagreements with their international counterparts at the International Accounting Standards Board (IASB) for the FASB to ultimately adopt ASC 842 via Accounting Standards Update or ASU 2016-02 on February 25, 2016.

The new lease accounting standards, FASB's ASC 842 and its international equivalent IASB's International Financial Reporting Standards or IFRS 16 both require non-governmental entities and certain not-for-profit organizations to include both lessee and lessor lease obligations of both real estate and equipment assets in their financial statements, regardless of whether the lease is classified as an operating or financing lease. The new lease accounting rules provide better transparency of the monetary value or economic benefits, as well as the timing and uncertainty of the cash flows from or due to leases.

For many, fully understanding ASC 842 has been the source of immediate frustration. How can organizations gain leasing compliance if they are unclear on the implications of what the accounting standards mean?

The primary objective of ASC 842 is to increase transparency and comparability in financial reporting related to leases. It requires lessees to recognize lease liabilities and right-of-use assets on their balance sheets for most leases including operating leases with a term greater than 12 months. Additionally, lessors must classify leases as either sales-type, direct financing, or operating leases, with specific criteria determining each classification. The standard mandates expanded disclosure of lease-related information in financial statements and related notes to ensure transparency.

To remain compliant with ASC 842, companies need to implement a structured approach that involves identifying and assessing all lease agreements both as lessees and lessors to accurately record lease liabilities and corresponding right-of-use assets. This entails capturing lease terms, determining appropriate discount rates, and regularly reassessing variables for changes. Robust internal controls and data management systems are essential to ensure accurate data collection and financial reporting.

In addition, companies must enhance their financial statement disclosures to provide comprehensive information about lease obligations, facilitating transparency and compliance with the standard's disclosure requirements. Regular training for personnel involved in lease management and accounting, as well as staying informed about updates or amendments to the standard, is crucial for ongoing adherence to ASC 842.

Download the ASC 842 Compliance Checklist to simplify lease accounting, reduce audit risk, and stay on track with evolving standards.

Finding the best ASC 842 lease accounting software involves a comprehensive evaluation of features, scalability, user-friendliness, integration capabilities with existing systems, compliance with the ASC 842 standard, and customer support. Prioritize solutions that offer robust lease data management, tracking of lease terms and changes, accurate financial reporting, and effective disclosure management. Consider user reviews and industry reputation to gauge reliability and performance.

ASC 842 came into existence as a result of the Enron fallout. At its height, Enron was a much riskier company than its published financial statements indicated in 2001. This was mostly due to its significant use of leases, which under the old leasing disclosure regulations -- FAS 13 / ASC 840 -- only required capital leases on the balance sheet.

Infamously, Enron fell on hard times, entering Chapter 11 bankruptcy in 2001, exiting said bankruptcy in 2004, all before selling its last asset in 2006. Along the way, shareholders lost over $11 billion, and the Sarbanes-Oxley Act of 2002 came into existence in an attempt to improve public firm disclosures and hold executives accountable. Enron's accounting firm Arthur Anderson was dissolved, and the SEC tasked the FASB to improve lease disclosures overall.

ASC 842 requires companies to classify all leases as either finance or operating leases. According to Investopedia, a finance lease is like a rental contract where a lessee can use an asset, such as a car or other equipment, and, after the lease is over, they have the option to own it. However, the owner (lessor) must fulfill all of their responsibilities as outlined in the contract. An operating lease, on the other hand, allows the use of an asset without a transfer of ownership.

This classification determines how the lease is recognized on the balance sheet and income statement. For finance leases, companies must recognize an asset and liability equal to the present value of the lease payments. For operating leases, companies must recognize a lease liability and a corresponding right-of-use asset on the balance sheet.

The implementation of ASC 842 has significant implications for companies' financial statements. By recognizing all leases on the balance sheet, companies' total assets and liabilities will increase, which may impact their debt-to-equity ratios and other financial ratios. Companies will also need to provide additional disclosures about their leases, including lease term, discount rate, and lease payments.

The implementation of ASC 842 requires companies to gather detailed information about their leases, including lease terms, renewal options, and lease payments. This information may not be readily available, and companies may need to invest in new systems and processes to capture and report this data. Companies will also need to train their employees on the new standard and work closely with their auditors to ensure compliance.

For US public and all international companies, the deadline to comply with ASC 842 and IFRS 16 began for fiscal years beginning after December 15, 2018 for US public companies and January 1, 2019 for all international companies.

US private companies had until December 15, 2019 to comply with ASC 842, but received a reprieve in July of 2019 allowing a year-long extension and a new adoption date for fiscal years beginning after December 15, 2020.

ASC 842 requires organizations with lease assets to recognize nearly all leases as assets and liabilities, whether classified as operating leases or financing leases, subject to certain exemptions. For the lessee or lessor, the recognition of more ASC 842 governed lease-related assets and liabilities, as well as changes to the timing of lease expense recognition, has had significant financial reporting and business implications.

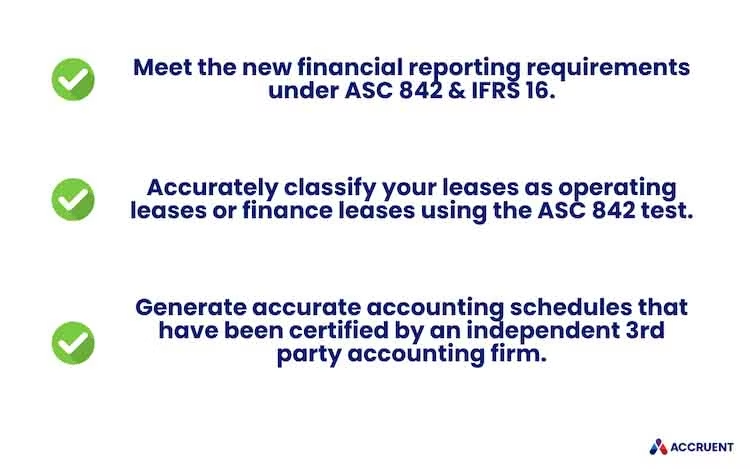

With the new ASC 842 and IFRS 16 accounting standards, compliance is more complicated and demands a higher level of internal effort. Whether it is finding leases, creating new workflows to manage them or understanding the new monthly closing process around them, ASC 842 and IFRS 16 require more work.

Fortunately, ASC 842 software can help.

Designed to meet the needs of both real estate and equipment leases, Accruent's Lucernex Lease Administration and Accounting solution allows users to mitigate risk, improve business processes and make better financial decisions for their business. Lucernex enables you to:

Learn more about how we can help you become compliant under ASC 842 and IFRS 16.

Schedule a demo and to learn more about how we can help you become compliant under ASC 842 and IFRS 16, contact us today!

ASC 842 applies to all public and private U.S.-based companies and nonprofits that follow U.S. GAAP and have leasing agreements, including real estate and equipment leases.

Both finance leases and operating leases longer than 12 months must be disclosed on the balance sheet, including their right-of-use (ROU) assets and liabilities.

It increases transparency by requiring lease liabilities and right-of-use assets to be reported, impacting debt ratios, EBITDA, and overall financial metrics.

Make sense of your data. See how to explore assumptions in FASB lease accounting, understand finance and operating lease requirements, and generate ...

Learn about the importance of roll-forward reports in lease accounting and how a lease accounting solution can streamline these tasks and improve ...

Learn the basics of lease accounting and types of leases, why lease accounting is important, and how FASB and IFRS standards have changed.

Subscribe to stay up to date with our latest news, resources and best practices.

* To unsubscribe at any time, please use the “Unsubscribe” link included in the footer of our emails.