Unlocking the Power of IWMS: The Building Blocks of a Connected Workplace

Discover how Integrated Workplace Management Systems (IWMS) are transforming the way organizations manage real estate, operations and hybrid work.

Solutions

Workplace Management Solutions

Real Estate Management Solutions

Maintenance Management Solutions

Energy Management Solutions

Engineering Document Management Solutions

Asset Management Solutions

Automate campus scheduling for classes, meetings, and exams with our EMS software.

Plan and manage conferences effortlessly with EMS software to impress guests and streamline operations.

Boost workplace flexibility and maximize space use with seamless desk and room booking.

Organize workplace or campus events smoothly, creating memorable experiences.

Optimize workspace, manage allocations efficiently, and reduce costs with our space management solutions.

Deliver projects on time and within budget by improving communication, collaboration, and efficiency with our software.

Streamline lease accounting for ASC 842, IFRS, and GASB compliance.

Manage leases efficiently by tracking key dates, analyzing costs, and ensuring compliance.

Centralize data and analytics for better insights, faster negotiations, and revenue growth.

Centralize facility and asset maintenance, automate work orders, and ensure compliance with our CMMS software.

Extend asset life, reduce downtime, and prevent costly repairs with data-driven monitoring.

Prevent equipment failures and extend asset life by detecting and addressing issues early.

Make sustainable, cost-efficient energy decisions by monitoring and optimizing power consumption.

Remotely monitor and control equipment with real-time data to predict issues, boost efficiency, and reduce downtime.

Easily share and collaborate on documents, creating a single source of truth for engineers and contractors.

Manage and analyze assets across their lifecycle to schedule maintenance, reduce downtime, and extend lifespan.

Improve visibility, automate work orders, and ensure compliance for efficient facility and asset management.

Resources

Browse our full library of resources all in one place, including webinars, whitepapers, podcast episodes, and more.

Self-Service & Support

Looking for self‑service training, best practices, helpful videos, product resources, or support? You’re in the right place.

About Accruent

Get the latest information on Accruent, our solutions, events, and the company at large.

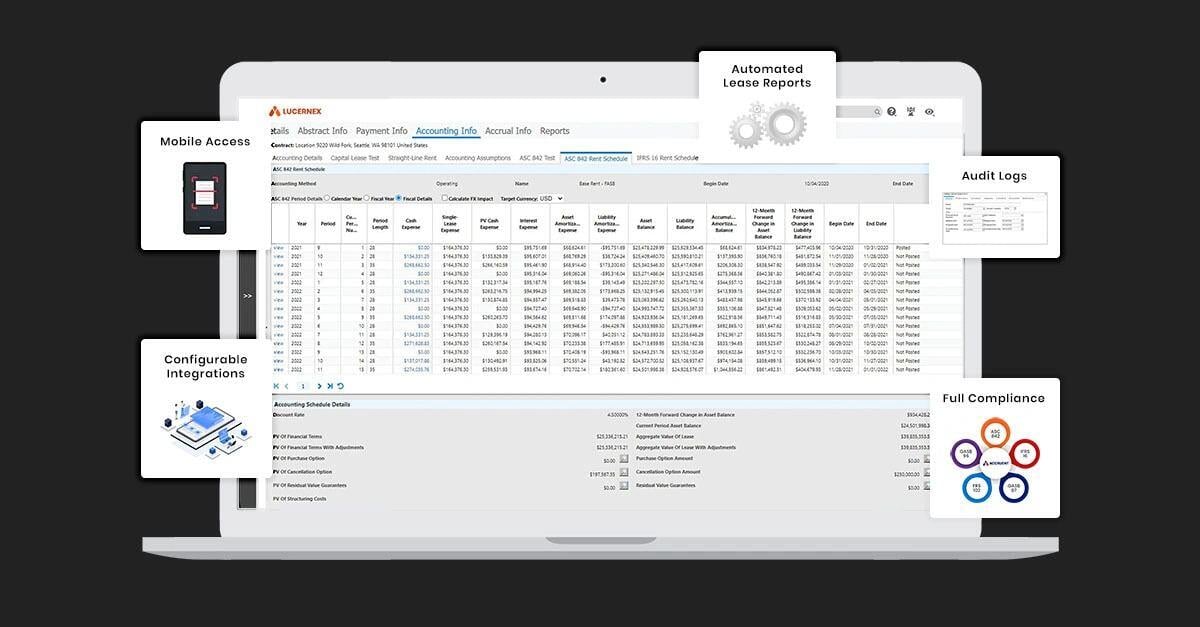

Stay audit-ready and compliant with ASC 842, IFRS, FRS 102 (FRED 82), GASB and other critical financial reporting standards using lease accounting software

Streamline reporting, reduce errors, and stay compliant with advanced lease accounting software.

Integrate lease data with your ERP and other systems to gain comprehensive insights and more more informed business decisions

Ensure adherency to accounting regulations to minimize the risk of non-compliance and avoid costsly penalties and legal complications.

Standardize and automate your financial reporting process to enhance operational efficiency and avoid the risk of errors.

Accruent’s solution gives you complete flexibility—supporting complex lease structures, evolving regulatory requirements, and multi-industry needs.

Easily meet ASC 842, IFRS 16, FRS 102 (FRED 82), IASB, and GASB standards. Leverage our 100% compliance success rate and robust audit logs and SOC certifications.

Calculate lease and expense obligations effortlessly with centralized, cloud-based data. Access lease details, dashboards, and tools to minimize human error.

Seamlessly integrate lease data with ERPs, accounting systems, and CRMs and more. Centralize your data for unified insights and improved efficiency.

Streamline data management and reporting with robust analytics. Get accurate financial reports, key data alerts, amendment tracking, and more--all in one place.

Boost efficiency with features like clickable lease abstracts document management, and workflow builders. Handle leases, insurance, and equipment leases effortlessly.

"Lucernex Lease Accounting Administration functions has streamlined us by allowing us to have all of the lease data in one place. We can tell when the lease is expiring, when we have renewals, what the net increases are."

— Kendall Dukes

Senior manager, Real Estate Processes and Lease Administration, Banfield Pet Hospital

Accruent Lx Contract proves its value daily, easily adapting to the specific lease accounting needs of different organizations

Accruent's lease accounting solution, busineses can centralize lease data, track key dates, and ensure compliance, helping to manage multiple locations efficiently and accurately.

By utilizing Accruent's lease accounting management software, CRE professionals can reduce operating costs, maintain compliance, and enhance the overall value of their properties.

Lease Accounting Software

Lease Accounting Software FAQs

Lease accounting doesn’t have to be difficult — as long as you are using configurable lease accounting software. Full-service lease accounting solutions that are flexible enough to work and scale in your specific sector ― retail, corporate, healthcare, telecom, public sector, professional services, construction companies, and more ― make it easy to monitor your full lease portfolio, perform financial calculations, recognize assets and liabilities on balance sheets, and meet compliance regulations.

The best lease accounting software is one that will help you effectively identify, manage and reduce any financial risks associated with your lease portfolios by:

You will also want a tool that:

ASC 842 software is lease software that provides the functionalities needed to maintain compliance with FASB’s ASC 842 financial reporting standard. Lease accounting software ASC 842 closes the loophole that lets companies hide assets off their balance sheet, and it requires the disclosure of all a company's leased assets.

This is important because in many instances, companies enter into agreements that allow them to use intangible assets like software and consider those part of their lease. This is not the case under ASC 842. Using intangible assets like software is outside of the scope of ASC 842 (refer to ASC 842-10-15-1 for more information). Use the guidance in ASC 350 if you would like to include software into your lease arrangements.

Comprehensive ongoing support

The vendor's support staff should be able to provide you with ongoing product training, technical support and full customer support. Accruent global support team offers free superclass training, a proven certification training curriculum and a robust user network.

The right automations and functionalities for your business

The lease accounting tool you choose should meet your needs both out of the box and in the long term. Ask your potential vendors:

Customizable integrations

After the initial sale, many vendors do not offer product enhancements and innovations, so their products quickly become dated. Look for a company that continuously enhances its offerings based on feedback and market trends. In the same vein, make sure that the solution you choose is not siloed and that it will offer the continued functionality and integrations you will need down the line.

SOC report compliance

System and Organization Controls (SOC) reports are reports issued by third-party CPAs that help establish credibility of service providers. They establish credibility based on five categories: security, availability, processing integrity, confidentiality and privacy.

There are three types of SOC reports, though SOC type 1 and SOC type 2 are most relevant for lease accounting software.

You will want to make sure that your provider is compliant with SOC 1 and SOC 2 so you can be sure you're working with trustworthy software.

Yes, here is how Lucernex lease accounting software helped Banfield Pet Hospital centralize ease data, connect their accounting, and simplify lease information:

Banfield Pet Hospital Streamlines Lease Administration and Accounting

You can check out the full case study here.

The new accounting standard for leases is ASC 842 in the United States, which mandates the inclusion of most lease arrangements on the balance sheet. This means recognizing a lease liability and a right-of-use asset, aiming to provide a more accurate financial representation. Fortunately, Accruent LX Contracts is a lease management software solution designed to assist organizations in complying with ASC 842 as well as other international lease accounting standards.

The key difference between ASC 842 and ASC 840 lease accounting lies in how leases are reported on financial statements. Under ASC 840, many operating leases were kept off the balance sheet, leading to potential inaccuracies and reduced transparency in financial reporting. In contrast, ASC 842 requires most leases, including operating leases, to be recognized on the balance sheet. This means lessees must record both a lease liability and a corresponding right-of-use asset, providing a more accurate representation of a company's financial position. The transition to ASC 842 aims to enhance transparency, aligning lease accounting practices with a focus on economic reality and improving the consistency and comparability of financial statements.

Don’t see your question? Let us help you

Discover how Integrated Workplace Management Systems (IWMS) are transforming the way organizations manage real estate, operations and hybrid work.

Discover how FRED 82 impacts FRS 102 for UK & Irish businesses. Watch the video and download Accruent’s white paper to prepare for the 2026 changes.

Discover why businesses must act now to prepare for the FRS 102 lease accounting overhaul. Learn about FRED 82 changes and their impact across organizations.

Subscribe to stay up to date with our latest news, resources and best practices.

* To unsubscribe at any time, please use the “Unsubscribe” link included in the footer of our emails.