Why Restaurants & Food Service Must Deliver a Consistent Experience

Explore why it is critical to delivering a consistent experience within your food organization and the ramifications of a poor experience.

Solutions

Workplace Management Solutions

Real Estate Management Solutions

Maintenance Management Solutions

Energy Management Solutions

Engineering Document Management Solutions

Asset Management Solutions

Automate campus scheduling for classes, meetings, and exams with our EMS software.

Plan and manage conferences effortlessly with EMS software to impress guests and streamline operations.

Boost workplace flexibility and maximize space use with seamless desk and room booking.

Organize workplace or campus events smoothly, creating memorable experiences.

Optimize workspace, manage allocations efficiently, and reduce costs with our space management solutions.

Deliver projects on time and within budget by improving communication, collaboration, and efficiency with our software.

Streamline lease accounting for ASC 842, IFRS, and GASB compliance.

Manage leases efficiently by tracking key dates, analyzing costs, and ensuring compliance.

Centralize data and analytics for better insights, faster negotiations, and revenue growth.

Centralize facility and asset maintenance, automate work orders, and ensure compliance with our CMMS software.

Extend asset life, reduce downtime, and prevent costly repairs with data-driven monitoring.

Prevent equipment failures and extend asset life by detecting and addressing issues early.

Make sustainable, cost-efficient energy decisions by monitoring and optimizing power consumption.

Remotely monitor and control equipment with real-time data to predict issues, boost efficiency, and reduce downtime.

Easily share and collaborate on documents, creating a single source of truth for engineers and contractors.

Manage and analyze assets across their lifecycle to schedule maintenance, reduce downtime, and extend lifespan.

Improve visibility, automate work orders, and ensure compliance for efficient facility and asset management.

Resources

Browse our full library of resources all in one place, including webinars, whitepapers, podcast episodes, and more.

Support

Looking for access to technical support, best practices, helpful videos, or training tools? You’ve come to the right place.

About Accruent

Get the latest information on Accruent, our solutions, events, and the company at large.

Insights into the retail landscape in 2025 including consumer experience, sustainability, generative AI, immersive reality, hyper-personalization, intelligent growth, and more. Stay ahead, stay informed. Dive into Retail Revolution now!

Trying to figure out today’s consumer expectations is like predicting the weather. It takes a lot of guesswork and a little bit of luck!

Here, we’ll tackle the key challenges retailers are facing today, chat about the top trends, and investigate why staying informed is vital for continued success.

Customers want to know their purchases mean something to the world. It's really that simple.

The highest customer expectations involve dealing with a more conscientious brand. Retailers must take note of this, adjusting the experience to meet the customer’s evolving needs. Focusing on customer demands helps to improve customer loyalty.

Legacy systems are a burden for retailers, creating data silos, interrupting workflows, and capturing inaccurate information.

Consumers have heard enough broken promises. As people become more environmentally conscious and informed, it’s harder for companies to “fake” a green initiative.

Shoppers want to buy from brands that offer real solutions and are genuinely working to be regenerative. If you’re not there yet, don’t promote it until you are.

A recent study by the IHL Group revealed that retailers who have already embraced AI and machine learning (ML) tools are experiencing noteworthy success, achieving 2.3x more growth in sales and 2.5x more growth in profits, for the year 2023. 2024 projections indicate a similar trend.

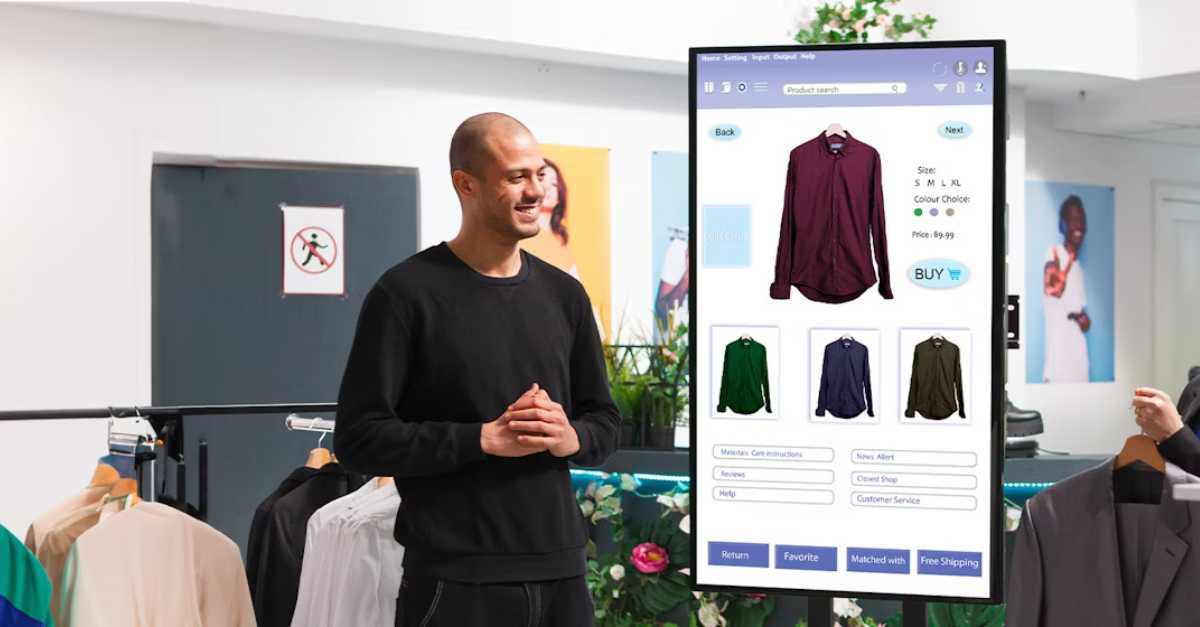

Today’s customers can easily buy things online. That’s why they are going into stores for the experience, more than anything. Don’t miss this opportunity.

Crate & Barrel’s flagship store in New York City is a multi-story, 23,000-square-foot space reimagined store with an on-site interior design studio. This creates a shoppable virtual environment, completing the circle for an omni-channel experience.

What are some other examples of experiential shopping? Download our eBook below.

Generation Alpha are the future customers you want to start directing efforts towards. These kids are digital natives at birth (born in and after 2010) and have grown up using smartphones and tablets.

The challenge for today’s retailers is delivering a hyper-personalized journey, without crossing the boundaries of privacy. Companies are using AI-driven personalization techniques to pull customers in, and then deliver through brick-and-mortar experience.

What does hyper-personalization look like?

Find out more in our full eBook below.

Grow smarter, not faster. For today’s retailers, driving growth will take some standout creative measures. In 2024, 94% of top U.S. retailers are prioritizing unit growth, with cautious consumerism expected to continue.

The average store size will continue to shrink. In 2023, retailers signed leases averaging 3,200 square feet (about the area of a tennis court), the smallest size since companies began tracking the data in the early 2000s.

Retailers need to integrate marketing, trade, and retail media spend, targeting specific consumers and “need states” with in-store merchandising. This helps to grow sales, maximize the budget, and improve margins.

Retailers are already using AI and machine learning for personalization and demand forecasting. Now, they are expanding its usage to other areas, like labor optimization,fulfillment decisions, and dynamic pricing.

Advancements in ML and the increase in computing power have enabled a myriad of computer vision solutions. One example is “Just Walk Out” technology, which has removed checkout friction, while providing store analytics about consumer behavior data. The system uses RFID tags to automatically track purchases as customers exit the store.

-1.jpg?width=1276&height=768&name=Top-Trends-Retail-2024_4%20(1)-1.jpg)

Retailers are now looking to automate more tasks with solutions like device management, modern self-checkout, fulfillment robots, and RFID adoption.

In-store employees continue to utilize improved tools (tablets and apps) for inventory management, sales, and training.

What are some other advanced technologies you can explore? Read more below.

The bottom line is you gotta make the customer happy.

With consumer expectations constantly on the rise, simply providing products isn't enough anymore. Retailers need to curate experiences that resonate with evolving consumer values.

Retailers need to be more than just providers of product.

The retail experience is undergoing a paradigm shift from immersive reality to experiential shopping. Companies are now compelled to create personalized encounters that go beyond the transaction.

Smart growth strategies, propelled by data-driven decisions, are essential for prioritizing customer needs. Those who embrace innovation, prioritize sustainability, and focus on creating an authentic experience for consumers, will emerge as industry leaders.

If you put the customer experience first, the rest of the pieces will fall into place.

Take a deeper dive with our eBook Retail Revolution: Trends Shaping Retail in 2024 and Beyond.

Explore why it is critical to delivering a consistent experience within your food organization and the ramifications of a poor experience.

Discover how to leverage a mobile app can improve a customer’s experience in a brick and mortar business.

Exhaust fans running around the clock. Doors on refrigeration units left open. Avoid these scenarios and cut consumption costs with real-time energy ...

Subscribe to stay up to date with our latest news, resources and best practices.

* To unsubscribe at any time, please use the “Unsubscribe” link included in the footer of our emails.