Unlocking the Power of IWMS: The Building Blocks of a Connected Workplace

Discover how Integrated Workplace Management Systems (IWMS) are transforming the way organizations manage real estate, operations and hybrid work.

Solutions

Workplace Management Solutions

Real Estate Management Solutions

Maintenance Management Solutions

Energy Management Solutions

Engineering Document Management Solutions

Asset Management Solutions

Automate campus scheduling for classes, meetings, and exams with our EMS software.

Plan and manage conferences effortlessly with EMS software to impress guests and streamline operations.

Boost workplace flexibility and maximize space use with seamless desk and room booking.

Organize workplace or campus events smoothly, creating memorable experiences.

Optimize workspace, manage allocations efficiently, and reduce costs with our space management solutions.

Deliver projects on time and within budget by improving communication, collaboration, and efficiency with our software.

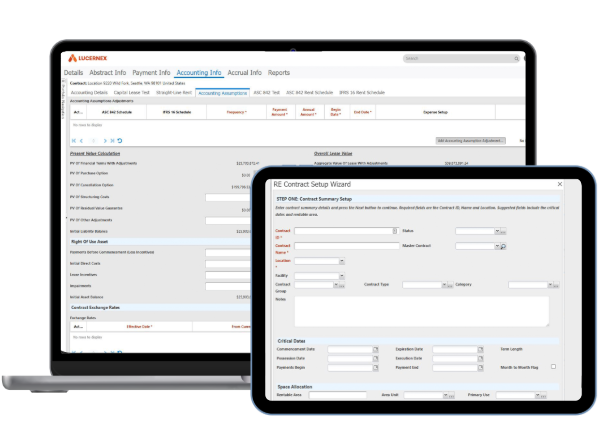

Streamline lease accounting for ASC 842, IFRS, and GASB compliance.

Manage leases efficiently by tracking key dates, analyzing costs, and ensuring compliance.

Centralize data and analytics for better insights, faster negotiations, and revenue growth.

Centralize facility and asset maintenance, automate work orders, and ensure compliance with our CMMS software.

Extend asset life, reduce downtime, and prevent costly repairs with data-driven monitoring.

Prevent equipment failures and extend asset life by detecting and addressing issues early.

Make sustainable, cost-efficient energy decisions by monitoring and optimizing power consumption.

Remotely monitor and control equipment with real-time data to predict issues, boost efficiency, and reduce downtime.

Easily share and collaborate on documents, creating a single source of truth for engineers and contractors.

Manage and analyze assets across their lifecycle to schedule maintenance, reduce downtime, and extend lifespan.

Improve visibility, automate work orders, and ensure compliance for efficient facility and asset management.

Resources

Browse our full library of resources all in one place, including webinars, whitepapers, podcast episodes, and more.

Self-Service & Support

Looking for self‑service training, best practices, helpful videos, product resources, or support? You’re in the right place.

About Accruent

Get the latest information on Accruent, our solutions, events, and the company at large.

Accruent's lease administration software does the heavy lifting for you, helping you manage dates, analyze rent costs, and seamlessly integrate into your existing solutions.

Provide transparency into your entire lease portfolio for better decision making.

Manage complex real estate portfolio and lease management scenarios, as well as equipment leases at every stage of the lease lifecycle.

Stop overpaying your landlords by reducing the risk of missing renewal and expiration dates, finding a clause in your lease that saves money, and conducting accurate CAM reconciliations.

Having lease cost data at your fingertips, including rental rates, term lengths, and tenant improvement allowances, means you can better set the market rate for a renewal or new opportunity.

Accruent's lease management software solutions are flexible enough to work and scale in your specific sector - retail, corporate, healthcare, telecom, public sector, and more.

Deliver powerful reporting through customizable dashboards, automated alerts, and detailed analytics that streamline lease oversight.

Stay on top of key dates with alerts, track amendments, covenants, and manage co-tenancy and subtenant details for comprehensive oversight.

Enhance operations with clickable lease abstracts, configurable dashboards, mobile access workflow builder, and document management.

Provides full transparency into your portfolio. Calculate lease and expense obligations, identify underperforming assets, and ensure team efficiency.

Avoid the risk of non-compliance or implementation failures. Our solutions guarantee 100% success in achieving compliance with global standards.

What Our Customers Say

"Lucernex Lease Accounting Administration functions has streamlined us by allowing us to have all of the lease data in one place. We can tell when the lease is expiring, when we have renewals, what the net increases are."

— Kendall Dukes

Senior manager, Real Estate Processes and Lease Administration, Banfield Pet Hospital

Accruent Lx Contract proves its value daily, easily adapting to the specific lease accounting needs of different organizations.

Accruent's lease accounting solution, businesses can centralize lease data, track key dates, and ensure compliance, helping to manage multiple locations efficiently and accurately.

By utilizing Accruent's lease accounting management software, CRE professionals can reduce operating costs, maintain compliance, and enhance the overall value of their properties.

Lease Administration Software

Lease management software is a digital solution that helps businesses track, manage, and optimize their lease agreements for real estate, equipment, and other assets. It centralizes lease data, automates key processes like rent payments, renewals, compliance tracking, and financial reporting, and ensures adherence to lease accounting standards such as IFRS 16 and ASC 842. By streamlining lease administration, organizations can reduce costs, mitigate risks, improve decision-making, and maintain a clear overview of their lease portfolio. The software is widely used by corporations, property managers, and finance teams to enhance efficiency and ensure lease-related obligations are met accurately.

Lease administration software provides a centralized platform to track and manage all lease-related data, ensuring accuracy, compliance, and efficiency. Key features include automated lease tracking, which helps organizations monitor expiration dates, renewal deadlines, rent escalations, and compliance requirements in one place. Advanced reporting and analytics provide insights into lease obligations, financial performance, and portfolio optimization.

These capabilities are essential for handling complex real estate portfolios and navigating challenging lease management scenarios across multiple locations. By streamlining lease processes, businesses can reduce financial risk, improve decision-making, and ensure regulatory compliance with ease.

The cost of lease administration software varies depending on several factors, including the number of leases managed, the complexity of features, deployment method (cloud vs. on-premise), and level of support required. Pricing models typically include subscription-based (SaaS), one-time licensing fees, or customized enterprise pricing. Small to mid-sized businesses may find entry-level solutions starting at a few hundred dollars per month, while large enterprises with extensive lease portfolios may require customized solutions with advanced automation, compliance tools, and integrations, which can range into thousands per month. Many vendors offer tiered pricing based on the number of leases or users, and some provide free trials or demo versions to assess the platform before committing.

Comprehensive tools for analyzing lease portfolios like lease expiration and renewal tracking, lease vs buy analysis, and lease cost benchmarking help organizations manage portfolios as they grow.

Quickly identify underperforming assets then segment those properties into a separate list. You can share these lists as reports with others across the organization.

Yes, Accruent’s Lx Contracts toolset allows companies to manage all types of leases including both property and equipment leases. Its functionalities cater to the specific requirements of each lease type.

Whether it is a retail company leasing warehouse equipment or a large portfolio of corporate property leases, organizations can easily manage the entire process with ease.

Users adopting Accruent's lease management software receive comprehensive support and training to ensure a smooth transition and effective usage. Accruent typically provides onboarding assistance, in-depth training sessions, user documentation, and knowledge base access to help teams get up to speed. Support options include live customer service, online ticketing, technical troubleshooting, and dedicated account managers for enterprise customers. Additionally, Accruent offers webinars, hands-on workshops, and ongoing product updates to help users maximize the software’s capabilities. For organizations requiring additional training, customized onboarding programs and implementation services are often available to align with specific business needs.

Don’t see your question? Let us help you

Discover how Integrated Workplace Management Systems (IWMS) are transforming the way organizations manage real estate, operations and hybrid work.

Discover key strategies and tools to optimize the entire retail real estate lifecycle in 2025 with this practical guide.

Discover how Accruent’s industry-leading CMMS solution, Maintenance Connection, simplifies compliance for highly regulated industries.

Subscribe to stay up to date with our latest news, resources and best practices.

* To unsubscribe at any time, please use the “Unsubscribe” link included in the footer of our emails.